CORAL GABLES, Fla. , April 19, 2024 /CNW/ – Sucro Limited (“Sucro” or the “Company”) (TSXV: SUG), an integrated sugar company focused primarily on serving the North American market, today announced financial results for the three and twelve months ended December 31 , 2023. All amounts are shown in United States dollars (“U.S. $” or “$”) unless otherwise noted.

Financial Highlights

Full-year revenues of $496.8 million on sugar deliveries of 476,778 metric tons; Q4 of $114.6 million and 95,883 metric tons, respectively Full-year net income of $20.0 million ; Q4 net loss of $10.4 million Full-year adjusted gross profit1 of $49.1 million and adjusted gross profit margin1 percentage of 9.9%; Q4 of $9.5 million and 8.3%, respectively Full-year EBITDA1 of $54.1 million and Adjusted EBITDA1 of $33.1 million ; Q4 of ($5.5 million ) and $8.3 million , respectively Full-year Adjusted gross profit per metric ton delivered1 2 of $94.37 ; Q4 of $55.64 For our refineries, Full-year volumes of 160,323 metric tons; Q4 of 34,287 metric tons For our refineries, Full-year Adjusted gross profit per metric ton delivered of $143.49 ; Q4 of $182.12 Q4 and Year-End 2023 Highlights (audited)

Three Months Ended December 31

Year Ended December 31

In 000s of U.S. $ except per share and volume metrics.

2023

2022

Change

2023

2022

Change

Sugar Deliveries (Metric Tons)

95,883

81,947

17 %

476,778

518,557

-8 %

Revenue

$

114,560

$

94,455

21 %

$

496,834

$

439,254

13 %

Gross profit

(4,857)

23,186

-121 %

70,285

72,416

-3 %

Adjusted gross profit 1

9,467

15,401

-39 %

49,126

38,291

28 %

Adjusted gross profit margin1

8.3 %

16.3 %

9.9 %

8.7 %

EBITDA1

(5,471)

18,086

-130 %

54,113

54,521

-1 %

Adjusted EBITDA1

8,308

10,452

-21 %

33,065

22,412

48 %

Adjusted EBITDA Margin1

7.3 %

11.1 %

6.7 %

5.1 %

Net Income (Loss)

(10,381)

15,685

-166 %

19,974

35,570

-44 %

Per share (basic)

(1.65)

2.27

-173 %

3.18

5.14

-38 %

Adjusted gross profit per metric ton delivered1,2

55.64

187.94

-70 %

94.37

73.84

28 %

Refineries Results:

Refineries Volume (Metric Tons)

34,287

19,345

77 %

160,323

83,615

92 %

Adjusted gross profit

$

6,244

$

2,276

174 %

$

23,004

$

9,480

143 %

Adjusted gross profit per metric ton delivered1

182.12

117.67

55 %

143.49

113.38

27 %

1. This is not a standardized financial measure under IFRS and may not be comparable to similar financial measures of other issuers. Please refer to “Non-IFRS and other Financial Measures” below for further details.

2. Net of cash settlements

“The Sucro team delivered a strong operational performance in 2023, which included valuable contributions from our US-based Lackawanna refinery during its first full year of operations,” expressed Jonathan Taylor , Founder and Chief Executive Officer of Sucro. “The addition of our new refinery capacity has had the desired effects – significant growth in our refined volumes and higher per ton profitability, the combination of which supported a 48% year-over-year increase in our Adjusted EBITDA.”

Taylor further commented “Our expectation in 2024 is to deliver further production growth from our existing operations while executing our refinery expansion plans. Our investment program for the year is focused on construction activities for our new refinery in Hamilton , and on advancing our recently announced new cane refinery at our University Park site in Illinois . Our teams remain highly focused on capitalizing on the strong, steady growth in sugar market demand we see on both sides of the border to deliver profitable growth to our shareholders.”

Q4 and Year-end 2023 Investor Call

The Company will host a conference call on Friday, April 19, 2024 , at 10:00 am Eastern time during which Jonathan Taylor , Founder and Chief Executive Officer, and Stefano D’Aniello, Chief Financial Officer, will discuss Sucro’s financial performance for the fourth quarter and year ended December 31, 2023 .

Date:

Friday, April 19, 2024

Time:

10:00 a.m. ET

Conference Call:

Toll-Free (888) 664-6392

Local (GTA) (416) 764-8659

Please dial in at least five minutes before the call begins.

Replay:

Available through May 6, 2024

Replay Access:

Toll-Free (888) 390-0541

Local (GTA) (416) 764-8677

Passcode 011068 #

Results from Operations – Three Months Ended December 31, 2023

Values are in 000s of USD except per share, sugar deliveries, and refinery volume metrics.

Quarter Ended December 31

2023

2022

Sugar Deliveries (Metric Tons)

95,883

81,947

Revenue

$ 114,560

$ 94,455

Cost of sales

119,417

71,269

Gross Profit

(4,857)

23,186

Adjusted gross profit

9,467

15,401

Adjusted gross profit margin

8.3 %

16.3 %

Income From Operations

(8,057)

17,002

Income Before Income Taxes

(14,404)

13,881

Net Income

(10,381)

15,685

Adjusted Gross profit/MT Delivered

0.10

0.19

Revenue/MT Delivered

1.19

1.15

Income from continuing operations– per share (basic)*

(1.65)

2.27

Income from continuing operations– per share (diluted)*

(0.45)

2.23

EBITDA

(5,471)

18,086

Adjusted EBITDA

8,308

10,452

EBITDA Margin

-4.8 %

19.1 %

Adjusted EBITDA Margin

7.3 %

11.1 %

Return on equity (annualized)

18.3 %

49.7 %

Adjusted gross profit per metric ton delivered (net of

cash settlements)

55.64

187.94

Refineries Results

Refineries Volume (Metric Tons)

34,287

19,345

Adjusted Gross Profit

$ 6,244

$ 2,276

Adjusted Gross Profit per MT

182.12

117.67

* Per share figures are as reported and do not make any adjustments for the Reorganization (defined in the Company’s most recent MD&A). The basic calculation does count each PVS as one share.

Customer sugar deliveries increased by 17.0% from 81,947 MTs for the quarter ended December 31, 2022 , to 95,883 MTs for the corresponding 2023 period, primarily due to the increase of deliveries from our facility in Lackawanna that offset decreased deliveries in Mexico (a market where we have now prioritized strategic opportunities over low margin sales) and decreased deliveries of organic sugar (as we have shifted free on board sales at origin for higher margin delivered sales in the U.S.).

Adjusted Gross Profit decreased to $9.5 million for the quarter ended December 31, 2023 , from $15.4 million for the corresponding 2022 period. This decrease was driven by lower Adjusted Gross Profit Margin (8.3% compared with 16.3% for the year ended December 31, 2023 and 2022, respectively), driven mainly by very favorable non-refinery sugar deliveries in the U.S. in the last quarter of 2022, as well as the year-over-year cost increases associated with having a full operating quarter for the Lackawanna refinery, which began operations in December 2022. For the same reason, Adjusted EBITDA was $8.3 million for the quarter ended December 31, 2023 , compared with $10.4 million for the corresponding 2022 period, a 25.0% decrease. Likewise, EBITDA was $(5.5) million for the quarter ended December 31, 2023 , compared with $18.1 million for the corresponding period in fiscal 2022, a 107.0% decrease driven by the growth of favorably priced physical forward contracts booked in the last quarter of 2022 (for deliveries in 2023), which was not replicated in 2023, in which we saw more gradual growth over the entire year, as well as due to period-end differences in forward commodity contracts’ mark-to-market adjustments.

Refined sugar deliveries from our own refineries increased by 77.2% from 19,345 MT in the three months ended December 31, 2022 , to 34,287 MT in the corresponding 2023 period, primarily due to our Lackawanna refinery which started operations in December 2022. Adjusted gross profit margins per metric ton on these volumes increased by 54.8% from $117.67 per MT in the three months ended December 31, 2022 , to $182.12 per MT in the corresponding 2023 period, primarily due to scaling of our Lackawanna facility in 2023, the first full year of operations, and favorable pricing conditions for refined sugar in some North American geographies, where we have been able to allocate significant volumes in 2023.

Results from Operations – Year Ended December 31, 2023

Values are in 000s of USD except per share, sugar deliveries, and refinery volume metrics.

Year Ended December 31

2023

2022

Sugar Deliveries (Metric Tons)

476,778

518,557

Revenue

$ 496,834

$ 439,254

Cost of sales

426,549

366,838

Gross Profit

70,285

72,416

Adjusted gross profit

49,126

38,291

Adjusted gross profit margin

9.9 %

8.7 %

Income From Operations

46,796

50,022

Income Before Income Taxes

26,331

41,749

Net Income (Loss)

19,974

35,570

Income from continuing operations– per share (basic)*

3.18

5.14

Income from continuing operations– per share (diluted)*

0.86

5.06

EBITDA

54,113

54,521

Adjusted EBITDA

33,065

22,412

Adjusted EBITDA/MT Delivered

69.35

43.22

EBITDA Margin

10.9 %

12.4 %

Adjusted EBITDA Margin

6.7 %

5.1 %

Total assets

543,929

380,052

Total non-current liabilities

67,581

60,556

Total Shareholders’ equity

141,825

109,127

Return on equity

18.3 %

49.7 %

Adjusted gross profit per metric ton delivered (net of

cash settlements)

94.37

73.84

Free cash flow

4,823

6,730

Refineries Results

Refineries Volume (Metric Tons)

160,323

83,615

Adjusted Gross Profit

$ 23,004

$ 9,480

Adjusted Gross Profit per MT

143.49

113.38

* Per share figures are as reported and do not make any adjustments for the Reorganization (defined in the Company’s most recent MD&A). Basic calculation does count each PVS as one share.

For the year ended December 31, 2023 , customer deliveries decreased by 8.1%, from 518,557 MTs in 2022 to 476,778 MTs in 2023, primarily due to our exit from low-margin local deliveries in Mexico that are unrelated to origination for our U.S. and Canadian businesses and, to a lesser extent, decreased deliveries of organic sugar, as we decreased large volume free on board (“FOB”) sales to focus on more profitable delivered contracts in the U.S. The decrease was offset by an increase in volume from our refineries, in particular our Lackawanna facility which started operations in December 2022.

Adjusted EBITDA was $33.1 million for the year ended December 31, 2023 , compared with $22.4 million for the corresponding 2022 period, a 47.5% increase, mainly as a result of higher Adjusted Gross Profit ($49.1 million for the year ended December 31, 2023 , compared with $38.3 million for the corresponding 2022 period). This improvement was driven by higher Adjusted Gross Profit Margin (9.9% compared with 8.7% for the year ended December 31, 2022 ) realized from our strategic focus on higher margin business at our U.S. and Canada refining and wholesale operations. As our refining operations in Lackawanna grow relative to the size of our overall sales book until we achieve full operating capacity, we expect margins to continue improving. Likewise, EBITDA was $54.1 million for the year ended December 31, 2023 , compared with $54.5 million for the corresponding period in fiscal 2022, a 0.7% decrease driven mainly by lower unrealized mark-to-market gains on physical sugar contracts, inventory, sugar futures contracts, and foreign exchange positions.

Net income for the year ended December 31, 2023 , amounted to $20.0 million , a decrease of $15.6 million when compared to net income of $35.6 million for the year ended December 2022. This decrease was driven primarily by lower unrealized mark-to-market gains on physical sugar contracts, inventory, sugar futures contracts, and foreign exchange positions, and increases in selling, general and administrative expenses, interest expense, and tax expense, as the Company continued to grow in size and scale.

Revenue for the year ended December 31, 2023 , increased by 13.1% to $496.8 million from $439.3 million for the year ended December 31 , 2022. Higher average sugar prices during the year ended December 31, 2023 (due to market conditions), partially offset a decrease in volumes sold. During the year ended December 31, 2023 , the Company’s volume of sugar sold decreased by 41,779 MTs, or 8.1%, which was driven by lower sales volumes in Mexico , a market where we intend to focus on strategic opportunities, as opposed to low-margin volume sales, and, to a lesser extent, decreased deliveries of organic sugar, as we decreased large volume FOB sales to focus on more profitable delivered contracts in the U.S.

Revenues are anticipated to increase in the 2024 fiscal year as commissioning of the Lackawanna refinery is completed and production and optimization rates move to anticipated operating levels. Sales from our Lackawanna refinery are now estimated at a range between 120,000 MT and 135,000 MT in Fiscal 2024. See “Outlook” below for additional details of the events and circumstances that caused the Company to revise this estimate.

The composition of the Company’s revenue for the years ended December 31, 2023 , and 2022 was as follows (Values are in 000s of USD) :

Year Ended December 31

2023

2022

Tolling

$ 1,306

$ 5,200

Warehousing

1,015

1,464

Commodity

495,316

432,347

Futures and options results

(803)

243

Total revenue

$ 496,834

$ 439,254

During the year ended December 31, 2023 , the Company’s futures and options losses were $0.8 million , compared with a $0.2 million gain for the corresponding 2022 period, a $1.0 million decrease relating to market losses on our Sugar 11 Contract futures contracts positions, which are used as hedging instruments for our physical positions. For the same periods, tolling revenues declined by $3.9 million (74.9%), primarily as a result of the shutdown of our Atlanta facility in February 2023 , which was mostly used to provide services to a third party, while warehousing revenues remained relatively flat.

The composition of cost of sales for the years ended December 31, 2023 and 2022, respectively, was as follows (Values are in 000s of USD) :

Year Ended December 31

2023

2022

Purchases

$ 327,494

$ 310,632

Production and processing

53,441

33,734

Logistics/ freight

44,121

42,717

Labour

7,024

5,665

Overheads

10,660

5,183

Foreign exchange loss

1,206

747

Depreciation on plant and equipment

3,093

1,692

Depreciation on right-of-use plant and equipment

345

354

Mark to market unrealized positions

(20,835)

(33,886)

Total cost of sales

$ 426,549

$ 366,838

Cost of sales increased by $59.7 million (16.3%) from $366.8 million for the year ended December 31, 2022 , to $426.5 million for the year ended December 31 , 2023. The drivers for the increase in cost of sales during the year ended December 31, 2023 , compared to the 2022 period included production and processing (a $19.7 million or 58.4% increase), logistics and freight (a $1.4 million or 3.3% increase), labor (a $1.4 million or 24.0% increase), overheads (a $5.5 million or 105.7% increase), and depreciation on plant and equipment (a $1.4 million or 82.8% increase), all of which saw increases relating to our Lackawanna refinery’s first full year of operations.

Mark-to-market gains on forward contracts and, to a lesser extent, inventory, drove the $20.8 million gains on unrealized mark-to-market positions for the year ended December 31, 2023 (compared with $33.9 million for the same period in fiscal 2022). Unrealized mark-to-market gains on inventory for the year ended December 31, 2023 , was $4.7 million ($0.5 million in 2022). This result was driven by favorable market conditions in the U.S. and Mexico. During the year ended December 31, 2023 , the Company had net unrealized mark-to-market gains on forward sugar contracts of $26.3 million compared with $32.5 million in 2022. The mark-to-market gains on commodity forward contracts were primarily driven by higher margins on booked forward contracts as of December 31, 2023 , while 2022 results were driven by both margins and volume, due to the startup of our Lackawanna facility.

During the year ended December 31, 2023 , the Company had unrealized losses of $9.1 million and $1.1 million on sugar futures contracts and foreign currency forwards, respectively (2022 – $0.9 million , and $0.0 million , respectively). These losses relate to hedging of Sugar 11 Contract and Mexican Peso positions on our inventory, forward contracts, and accounts receivable. See “Financial Risk Management” below.

The composition of selling, general and administrative expenses for the years ended December 31, 2023 , and 2022, respectively, was as follows (Values are in 000s of USD) :

Year Ended December 31

2023

2022

Administrative expenses

$ 18,455

$ 14,359

Selling and distribution expenses

866

544

Other operating expenses

2,619

4,014

Depreciation

1,460

664

Depreciation of right-of-use assets

550

475

Equity-based compensation

(461)

2,338

Equity-based settlement expense

–

–

Total Selling, General and Administrative Expenses

$ 23,489

$ 22,394

Total Selling, General and Administrative Expenses /

Revenue

4.73 %

5.10 %

The Company’s selling, general and administrative expenses amounted to $23.5 million for the year ended December 31, 2023 , an increase of $1.1 million (4.9%) when compared to expenses of $22.4 million for the year ended December 31 , 2022. As our operations continue to grow and scale, we expect selling, general and administrative expenses as a percentage of revenue to continue to decrease over time.

Administrative expenses, which include staff payroll, benefits and pension costs, professional fees, insurance, bank service charges and other office expenses were $18.5 million for the year ended December 31, 2023 , an increase of $4.1 million (28.5%) from $14.4 million for the year ended December 31 , 2022. The most significant driver of the increase in these expenses is additional personnel expenses at our newly commissioned refinery in Lackawanna , additional sales staff to support our growing sales volumes, and professional fees for legal and accounting as the Company increases the overall size of its operations and completed its initial public offering in October 2023.

During the year ended December 31, 2023 , the Company saw an increase in its selling and distribution expenses of $0.3 million , or 59.2%, from $0.5 million incurred during the year ended December 31, 2022 , to $0.9 million in the year ended December 31 , 2023. The marketing campaigns were consistent year over year and the main reason for this increase was related to commissions paid to third parties for sugar origination.

During the year ended December 31, 2023 , other operating expenses, including travel, business taxes and licenses, bad debts, outside labor and IT expenses, amounted to $2.6 million , a decrease of $1.4 million (34.8%) when compared to expenses of $4.0 million for the year ended December 31 , 2022. This decrease was mainly driven by the reversal of accrued expenses relating to the disposition of our Atlanta facility, as well as lower write-offs of accounts receivable and bad debt provision.

During the year ended December 31, 2023 , a net equity-based compensation recovery of $0.5 million was realized on the forfeiture of unvested incentive units awarded to a former employee who left the business.

During the year ended December 31, 2023 , the Company incurred interest expense of $22.9 million , an increase of $12.8 million , or 128.4%, over the year ended December 31 , 2022. The increase is a combination of increases to the Company’s overall borrowings, primarily to fund inventory and accounts receivable, but also an overall increase in the SOFR rate by 108 basis points in the U.S. from December 31, 2022 , to December 31, 2023 , which affects interest incurred on Sucro’s short-term financial liabilities.

The Company’s current and deferred income tax expense increased by $0.2 million from $6.2 million for the year ended December 31, 2022 , to $6.4 million for the year ended December 31 , 2023. The Company recognized $1.1 million and $5.3 million in current and deferred income tax expense, respectively, during the year ended December 31, 2023 , owing to deductions associated with unrealized gains on inventory and forward, futures and foreign exchange contracts, as well as with the difference between accounting and tax depreciation rates of property, plant, and equipment.

Outlook

In November 2023 , the Company updated its full-year 2023 earnings estimates, which were originally provided in the Company’s final prospectus dated October 19 , 2023. Adjusted EBITDA was revised to between $30.0 million and $32.0 million , while EBITDA was re-affirmed at between $63.0 million and $70.0 million . As noted above, the reported Adjusted EBITDA for 2023 was $33.1 million , above the revised estimate, and the reported 2023 EBITDA was $60.0 million , which is below our estimate.

The Company’s final prospectus also contained full-year 2024 EBITDA and Adjusted EBITDA estimates of between $73.0 million and $81.0 million and $49.0 million and $51.0 million , respectively. Production estimates for the Company’s refinery operations in Hamilton, Ontario and Lackawanna, New York were also provided in the Company’s final prospectus, with full-year 2024 production from Hamilton estimated at 130,000 MT, and Lackawanna production projected at 132,000 MT. We are revising our 2024 production estimate for our Hamilton facilities to between 105,000 MT and 115,000 MT, and for Lackawanna to a range of 120,000 to 135,000 MT. However, management is not revising 2024 EBITDA and Adjusted EBITDA estimates at this time.

As estimates for 2024 EBITDA and Adjusted EBITDA had been originally provided in the Company’s prospectus, we intend to update such guidance through the end of the 2024 reporting period. Due to the variable nature of Sucro’s trading operations and the developmental stage of the Company’s refining operations, Management intends to discontinue providing earnings guidance going forward. Given the growing importance of the Company’s refinery operations and its expected expansion as a proportion of its overall business activities, we intend to focus our forward guidance on delivery volumes from our refineries, along with information on Adjusted Gross Margin per metric ton of sugar delivered from our refineries, capital expenditures, and the debt and equity composition of the financing of any capital projects. We believe that these measures better align our targets and guidance with Management’s vision and long-term goals for Sucro.

Notwithstanding the above, we disclaim any intention or obligation or undertaking to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required under applicable securities laws.

Management has recently reviewed the Company’s commitments and opportunities for the application of its capital and has determined not to pay a dividend on the Company’s shares at this time in order to invest in more accretive opportunities, including funding planned capital expenditures. Any determination to pay dividends in the future will be at the discretion of the Board and will depend on many factors, including, among others, the Company’s financial condition, current and anticipated cash requirements, contractual restrictions and financing agreement covenants, solvency tests imposed by applicable corporate law and other factors that the Board may deem relevant.

Longer-term Outlook for our Refinery Operations

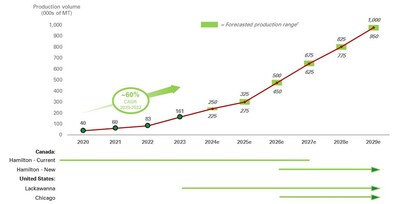

Sucro’s strategic plan is to grow its sugar sourcing, refining and distribution infrastructure, with an emphasis on low-capital-cost refining assets, and actively and efficiently manage the entire supply-chain cost of sugar, from the point of origin to the delivery to end-use customers in North America. Based on the Company’s announced plans for expansion of its refinery capabilities in the United States and Canada , and subject to several company and market factors that may impact its announced plans for expansion, Sucro currently forecasts material growth in its refinery production volumes over the next several years of operation. As the volume of sugar refined within facilities owned and operated by Sucro increases, refined volumes are expected to comprise a majority of the sugar deliveries made to Sucro’s sugar customers located throughout North America. Included below is a summary of the refinery production volumes to date, and estimated ranges of aggregate production based on the timing of expected production from each of our announced facilities.

Note: Readers are cautioned that forward-looking statements are not guarantees of future performance. Actual results could differ materially from those currently anticipated due to a number of factors and risks. See “Forward-Looking Statements”.

1.

Forecasted production based on announced refinery investments – Lackawanna, NY; Hamilton (New), ON; and expansion of Chicago, IL.

Awards of Stock Options and Restricted Share Units

The Company announced today that, subject to regulatory approval, it has awarded stock options and restricted share units (“RSUs”) pursuant to its Omnibus Equity Incentive Plan. The Company has granted stock options to acquire an aggregate of 342,846 Subordinate Voting Shares to employees, consultants and officers of Sucro subsidiaries, with each option exercisable until December 31, 2028 to acquire one Subordinate Voting Shares at a price of C$11.00 per share and vesting over a 30-month period from the date of grant. Subject to regulatory approval, the Company has also awarded 29,344 RSUs to non-executive directors and a consultant under the Company’s Omnibus Equity Incentive Plan. The RSUs awarded will vest after a one-year period.

Annual Meeting

The Company has called an annual and special meeting of shareholders to be held in Toronto, Canada on Thursday, May 30, 2024 .

About Sucro

Sucro is a growth-oriented sugar company that operates throughout the Americas, with a primary focus on serving the North American sugar market. The Company operates a highly integrated and interconnected sugar supply business, utilizing the entire sugar supply chain to service its customers. Sucro’s integrated supply chain includes sourcing raw and refined sugar from countries throughout Latin America , and refined sugar from its own refineries, and delivering to customers in North America and the Caribbean . Since its inception in 2014, Sucro has achieved significant growth by creating value for customers through continuous process innovation and supply chain re-engineering. Sucro has established a broad production, sales and sourcing network throughout North America with two cane sugar refineries and an additional value-added processing facility. The Company has offices in Miami , Mexico City , Sao Paulo , and Port of Spain . For more information, visit sucro.us and follow us on LinkedIn .

Non-IFRS and other Financial Measures

In this news release, reference is made to the following non-IFRS measures: “EBITDA”, “EBITDA Margin”, “Adjusted EBITDA”, “Adjusted EBITDA Margin”, “Adjusted Gross Profit”, “Adjusted Gross Profit Margin”, and “Adjusted Gross Profit Per Metric Ton”. Such non-IFRS financial measures are not standardized financial measures under International Financial Reporting Standards (“IFRS”) and might not be comparable to similar financial measures disclosed by other issuers. For details on the composition and a reconciliation between such non-IFRS measures and the most directly comparable financial measure in our financial statements, please refer to the “Other Selected Financial Information (Key Performance Indicators) –Non-IFRS Measures” section in our MD&A dated April 18, 2024 and filed on SEDAR+ at www.sedarplus.ca , which is specifically incorporated by reference herein.

Forward-Looking Statements

This Press Release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) within the meaning of applicable Canadian securities laws. Forward-looking information may relate to our future financial outlook and anticipated events or results and may include information regarding our financial position, business strategy, growth strategies, addressable markets, budgets, operations, financial results, taxes, dividend policy, plans and objectives. Particularly, information regarding our expectations of future results, performance, achievements, prospects or opportunities or the markets in which we operate is forward-looking information. In some cases, forward-looking information can be identified by the use of forward-looking terminology such as “annualized”, “plans”, “targets”, “expects”, “does not expect”, “is expected”, “an opportunity exists”, “budget”, “scheduled”, “estimates”, “outlook”, “forecasts”, “projection”, “pro forma”, “prospects”, “strategy”, “intends”, “anticipates”, “does not anticipate”, “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will”, “will be taken”, “occur” or “be achieved”, or the negative of these terms, or other similar expressions intended to identify forward-looking statements. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events or circumstances.

This forward-looking information includes, among other things, statements relating to: future production growth; anticipated increase in revenues for 2024; our revised 2024 Lackawanna and Hamilton refinery production guidance; our expectations regarding our profit and operating margins; our expectation for decreased volume of business in Mexico ; our expectations for selling, general and administrative expenses as a percentage of revenue to decrease over time; our expectation for revenues for the 2024 fiscal year; and our expectations of future production from Sucro’s current and announced refineries.

This forward-looking information and other forward-looking information are based on our opinions, estimates and assumptions in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we currently believe are appropriate and reasonable in the circumstances. Despite a careful process to prepare and review the forward-looking information, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct. Certain assumptions include: revenue; our ability to build our market share; our ability to complete our proposed new refineries on time and on budget and with the anticipated processing capacity; our ability to retain key personnel; our ability to maintain and expand geographic scope; our ability to execute on our expansion plans; our ability to continue investing in infrastructure to support our growth; our ability to obtain and maintain existing financing on acceptable terms; currency exchange and interest rates; the impact of competition; our ability to respond to any changes and trends in our industry or the global economy; and the changes in laws, rules, regulations, and global standards are material factors made in preparing forward-looking information and management’s expectations.

Forward-looking information is necessarily based on a number of opinions, estimates and assumptions that, while considered to be appropriate and reasonable as of the date of this Press Release, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including, but not limited to, our ability to maintain and renew licenses and permits; fluctuations in the price of sugar that we purchase, process and sell; development of new or expansion of our existing refineries may experience cost-overruns and/or delays and actual costs, operational efficiencies, production volumes or economic returns may differ materially from the Company’s estimates and variances from expectations; disruptions to our supply chains as a result of outbreaks of illness, geopolitical events or other factors; inflation and rising interest rates; the risk of unhedged trading positions and counterparty defaults; a significant portion of our current credit facility is uncommitted and requests for additional advances may be refused; elimination or significantly reduction of protective duties relating to foreign sugar imports; our limited operating history and our recent growth may not be indicative of our future growth; dependence on management’s ability to implement its strategy; risks of early stage companies; competitive risks; our dependence on a small number of key persons; demands of growth on our management and our operational and financial resources; and the other risk factors discussed in greater detail under “Risk Factors” in the Company’s annual information form dated April 18, 2024 and filed on SEDAR+ at www.sedarplus.ca , which is specifically incorporated by reference herein.

The above-mentioned factors should not be construed as exhaustive. If any of these risks or uncertainties materialize, or if the opinions, estimates or assumptions underlying the forward-looking information prove incorrect, actual results or future events might vary materially from those anticipated in the forward-looking information.

Prospective investors should not place undue reliance on forward-looking information, which speaks only as of the date made. The forward-looking information contained in this Press Release represents our expectations as of the date of this Press Release (or as of the date they are otherwise stated to be made) and is subject to change after such date. However, we disclaim any intention or obligation or undertaking to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required under applicable securities laws. For additional information, readers should also refer to our Final Prospectus and other information filed on www.sedarplus.ca .

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Sucro Limited